Another way in which you can fund your business is by means of crowdfunding.

What is crowdfunding?

Crowdfunding is a practice by which someone publishes his project in an online platform requesting funding for it, so that one or more people looking to invest their money can finance it based on the conditions previously established in said platform.

How does it work?

An entrepreneur publishes the project for which he is seeking funding in an online crowdfunding platform and establishes the amount of investment needed as well as the deadline to gather the funds. Anyone looking to invest their money, regardless of the sum, looks for these funding platforms and, upon finding a project in which they wish to invest, they transfer their money to the online platform. Once the money is transferred, it will only be given to the entrepreneur once they raise the necessary funds within the established period. In case of not raising enough money, the platform will return the money to each of the investors.

Crowdfunding can be carried out in several ways:

What are the types of crowdfunding?

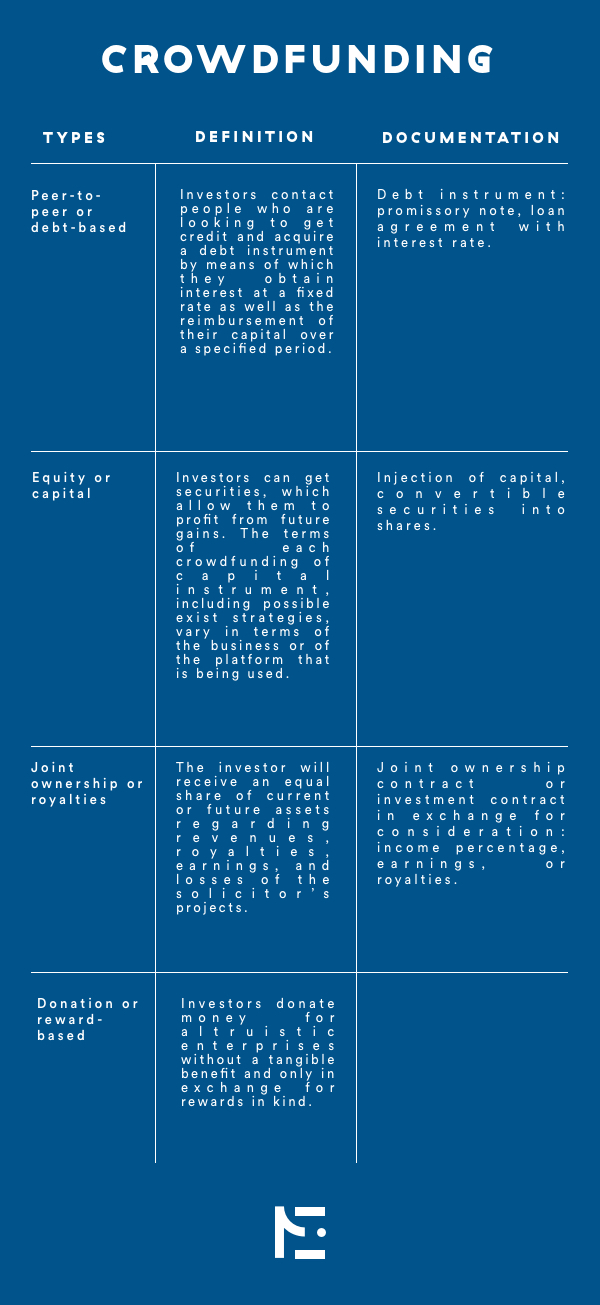

There are four types of crowdfunding campaigns to fund your business or projects: peer-to-peer or loan-based, equity-based, joint ownership and royalties, and reward or donation-based.

Peer-to-Peer, Peer-to-Business, Loan-Based: Perhaps you are looking to loan your money and expect a return on investment at an appealing interest rate. Peer-to-peer crowdfunding consists in requesting a loan to finance your project or business in exchange for interest payments in the future.

You might wonder: why would you, as an entrepreneur, prefer a loan granted through a website by a group of strangers when you could get it from a credit institution? First, there are several requirements set down by the bank, such as your credit history, having lived for a number of years in your current address, and the time that has elapsed since the incorporation of your company, among others. The second reason is the time that it takes for your request of a loan to be granted by credit institutions. Lastly, the interest rates of those who invest in your business are lower than the bank’s, and this will prevent the absorption of your project’s profits by the payment of interests.

Equity-Based or crowdfunding of capital: Equity crowdfunding allows the investor to make a capital injection in exchange for securities; in other words, the investor is looking to become a stockholder of the business and take part of its future profit by means of dividend payment.

If you accept this kind of crowdfunding, you must take into account that the investor will become a stockholder and will therefore acquire property rights; that is, the stockholder will have the right to a share of the business’ profits throughout the years. He might also acquire corporate rights or the right to make decisions for the business, participate and vote in shareholder meetings, and have a say in choosing the board of directors and legal representatives.

Joint ownership or royalties: While the business has the duty to return the investment, by means of this kind of crowdfunding it will not be necessary to return money or issue stock; rather, the entrepreneur can offer a percentage of the revenue once it begins to generate capital by offering to share ownership of the business with the investor.

Donation or reward-based: This last type of crowdfunding consists of funding for businesses or companies that does not require its return. This kind of crowdfunding involves associations of groups of people who are looking to donate their money in an altruistic way, oftentimes to support some type of social program. Rewards allow the company or business to return the investment in kind by the distribution of their products or lending of their services.

What do you need to know in order to participate in crowdfunding?

Crowdfunding is currently regulated by Mexican legislation through the Financial Technology Institutions Law (the “Law”) adopted on March 9, 2019. The Law is also called Fintech Law because it regulates businesses that provide financial services using technology—websites, apps, and social media—in order to expedite and facilitate processes.

The Law includes crowdfunding, and it is regulated by the following terms:

In Mexico there are around 25 registered crowdfunding platforms; the Financial Inclusion Report number 9 published by the CNBV and the CONAIF stated the following regarding crowdfunding:

“During 2017, nearly eight thousand companies acquired financing for their projects in the form of debt-based crowdfunding and crowdfunding of capital, showing a growth rate of 280% when compared to 2015. […]In 2017, little more than 1,500 companies obtained funds for their projects in the form of non-financial crowdfunding, that is, reward or donation-based, which resulted in a growth of 153% in comparison to 2015. […] At the same time, the number of investors or individuals funding projects in 2017 was little over 83,000, which compares favorably with the 46,000 registered in 2015 […] The number of projects launched in any of the previously mentioned platforms totaled over 130,000 from 2015 to 2017. The growth from one year to another neared 500%. The number of transactions through those platforms during the same periods totaled little under 1.4 million.

We can conclude that crowdfunding has gained relevance and consolidated in Mexico in the last years, but it is just beginning and it turns out to be a good financing option for entrepreneurs, as well as a good option for investing. Thanks to the new regulations, crowdfunding presents fewer risks, even though it is important to do research before engaging in crowdfunding projects so that you understand how it works.